Tax Tips

White Perkins Associates- helping you with your 2020 personal taxes:

Scroll down for tips on:

Buying, building, selling or renovating a home

Digital Subscription Tax Credit

Missing government issued T-slips and ensuring your contact and other information is current

Medical travel expense

Business use of home office expense

Medical expense- Prescription summaries

Donations

Did you buy, build, sell or renovate a home in 2020? The CRA article linked below outlines information relating to the relevant tax credits and reporting.

Digital Subscription Tax Credit

New for the 2020 Tax Season!

You may now claim up to $500.00 (which would give you a federal tax credit of $75.00) for the amount you paid in 2020 for qualifying Canadian digital subscriptions. The organization must not hold a license to broadcast, and the digital subscription must be for content that is primarily news. The person who holds the subscription is the one who must claim it. If two people share this subscription, it can be split, but the total claimed can not exceed the maximum amount.

If the subscription also gives you non-digital content, such as a physical newspaper delivered and digital access to that news organization for one fee, you can only claim the cost of either a comparable stand-alone digital subscription, or if there isn’t one, then ½ of the amount paid.

To claim this credit, either bring in your receipts for subscription fees for 2020, or bring in the total amount paid, the name of the organization, and if your subscription is digital only. Canada Revenue Agency is compiling a list of qualified Canadian journalism organizations (QCJOs) but this is still in its infancy.

To see this list which will be updated as news organizations file their paperwork:

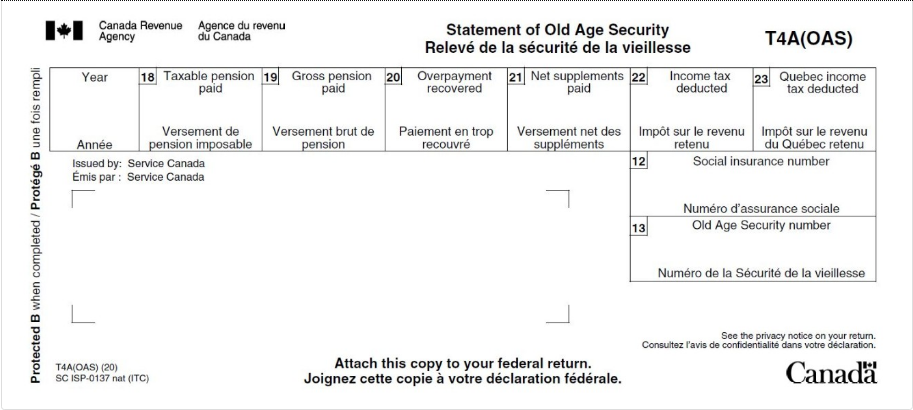

Are you waiting for the arrival of your T-slips for government programs such as Old Age Security (T4A OAS), Canada Pension Plan (T4A P), Employment Insurance (T4E) or your T4A for CERB or other 2020 COVID-19 programs before bringing in your personal tax information?

We have heard from a few clients that their T-slips from CRA have not arrived or are yet to arrive; however, where we are authorized representatives for clients, we have been able to download these slips.

If you have all your other tax information gathered, bring it to us, and we will check online for your government issued T-slips.

Waiting for T-slips?

Let us check for you!

Pro tip

If any of your contact or other information has changed from last tax season, please let us know when you drop off your information! Some of this information includes:

New address

New phone number (or removing a number, such as disconnecting your home phone, and only having cell)

Change of email address

Change of name

New spouse or common law spouse, separation, or divorce in 2020

New family member in 2020 (Congrats!)

Qualifying for the disability tax credit

Medical Travel

When you need to travel more than 40 km for medical appointments, procedures etc., you may be eligible to claim mileage for this travel as part of your medical claim on your personal tax return.

What are the conditions for eligible medical travel?

1.You have travelled more than 40km each way to your medical appointment.

2. There is not a provider that you could have seen who was closer. (e.g., You can not claim travel for a dentist in Bridgewater if you live in Yarmouth just because they were your dentist when you previously lived in Bridgewater and you prefer to stay with them.) However, you can claim medical travel to see your doctor if you can not get another doctor closer to where you live.

What expenses may I claim?

1. You may claim mileage with any medical travel over 40 km each way.

2. You must claim the shortest practical route even if that is not the route that you chose.

3. If the length of your trip was over 80 km, you may also claim a meal (or as many as would be deemed reasonable for your travel). The rate used to claim a meal under the simplified method has increased to $23.00 for the 2020 tax year.

4. If a medical professional would deem that it was medically necessary for you to have an attendant, you may also claim meals for your attendant.

What documentation do I need to bring for a medical travel claim?

1. A list of medical travel for the year. This list should include for each appointment:

The date(s) of travel (e.g., March 1-3 for an operation in Kentville where you went up on the 1st and were released to go home on the 3rd.)

The name of the patient for each appointment if there is more than one person in your household.

The destination of your travel.

The reason for your travel.

If you had a medically necessary attendant.

2. Back up documents such as a page confirming a doctor’s appointment. In some cases, you will already be submitting this documentation if there was a charge involved and you are claiming the expense as well, such as an optical appointment.

3. Any parking or accommodations receipts for your travel. If you needed to stay overnight in Halifax for a medical appointment the next morning and had to pay parking at the hospital, you can claim this as part of your medical travel claim.

Business use of home office expense for employees

For 2020 in recognition of how many employees had to work from home due to the Covid 19 pandemic, CRA has come up with a simplified method to calculate home use. As of now, this method may only be used for the 2020 tax year.

Who may use the simplified method?

1. If, due to Covid-19, you were required by your employer to work from home, OR you were given the choice by your employer and you chose to work from home.

2. You worked from home more than 50% of the time for at least 4 consecutive weeks in 2020.

3. The only employment expenses you are claiming are business use of home.

4. Your employer did not reimburse you for all home office expenses. If you were reimbursed for some only, you may still use this flat rate calculation.

How do you use the simplified method?

You claim $2.00 per day for all days that you worked from home due to the pandemic in 2020 up to a maximum of $400.00.

Which days counts as work days and which do not?

A work day is a day when you worked either full-time or part-time hours from home.

Days do not count if they were days off, vacation days, sick leave days or days with any other leave or absence.

What are the advantages of the simplified method?

1. You do not have to calculate the size of your workspace and locate and add up all the relevant home receipts.

2. If you use an accounting professional, it will be much faster for them to process, saving you money on your tax return.

3. You do not have to ask your employer to fill out a T2200 form as you would with the detailed method.

4. Your claim does not depend on the actual amount of your expense.

NOTE: You cannot claim other employment expenses if you are using the flat rate method. It is recommended that you consider each option to ensure you choose that method most beneficial to you.

If you choose to use the detailed method, you need to bring us the following information:

1. Obtain a signed T2200 form from your employer.

2. Calculate the square footage of your home office and have available also the total square footage of your home.

3. Gather the eligible expenses as shown below:

As you gather your 2020 donation slips from registered Canadian charitable organizations, remember that donation receipts are usable for up to 5 years. This means that any donations made in the 5 previous years that have not been claimed before are eligible to be claimed in 2020. It also means that any 2020 donation receipts are claimable until the 2025 tax year.

If you want to find out if a charity is registered, where they are located or other information,

You can find this on the CRA website at:

https://apps.cra-arc.gc.ca/ebci/hacc/srch/pub/dsplyBscSrch?request_locale=en