current news

January 16, 2024

NOTICE - ACCOUNTING OFFICE

Please be advised that Phil Gaudet, CPA and Rob Fuller, PBA will be combining professional services and opening an accounting office at 291 Meteghan Connector on January 22, 2024 under the professional partnership of White Perkins Associates, CPAs Inc.

Phil would like to advise his valued clients that they can contact him by phone 902-769-2000 or email phil.gaudet@wpacpa.ca. Yarmouth or Pubnico drop-off or pickup can be arranged.

Rob would like to advise his valued clients that he will be present in that office at least two days per week, usually Thursdays and Fridays. Clients are welcome to drop off at the new Clare office or the White Perkins Associates - Yarmouth office. Pubnico drop-off can also be arranged.

There will be staff at that location between 8:30 and 5:00 Monday to Friday (as well as 8:30 to 12:00, on Saturday, for the tax season). Looking forward to seeing existing clients as the year continues!

March 2, 2023

Underused Housing Tax Act (UHTA)

The Government of Canada has introduced an underused housing tax on the ownership of vacant or underused housing in Canada. The Underused Housing Tax Act (UHTA), which governs the underused housing tax, received royal assent on June 9, 2022. The underused housing tax took effect on January 1, 2022.

The underused housing tax is payable by non-resident non-Canadian owners of vacant or underused housing in Canada. Most Canadian owners of residential property are excluded owners and, therefore, do not have any obligations and liabilities under the UHTA. However, the underused housing tax is payable by certain Canadian owners of housing in limited situations.

Some affected owners must file an annual return and pay the underused housing tax. These include corporations that are owned more than 10% directly or indirectly by non-resident non-Canadians. Other affected owners will be required to file an annual return, but not pay the underused housing tax. Examples include corporations, trusts, estates, and partnerships. Excluded owners do not have to file an annual return or pay the underused housing tax.

There are significant minimum penalties ($10,000 for corporations; $5,000 for individuals) if you fail to file an annual return when it is due.

For more information about Who is an affected owner and Who is an excluded owner, Conditions for filing a return, and Conditions for paying the tax, please refer to this link - https://www.canada.ca/en/revenue-agency/services/forms-publications/publications/uhtn1/introduction-underused-housing-tax.html

February 1, 2023

National Speed Jobbing

The National Speed Jobbing is an opportunity for employers in the southwest to meet with candidates from Nova Scotia (with work status in Canada), but also to have access to a database of candidates elsewhere in Canada (for a possible move). Please find a document explaining the benefits for employers for participating, and the registration link is as follows:

https://www.eventbrite.ca/e/recruiter-registration-virtual-speed-jobbing-tickets-513252310477

November 30, 2022

Get money and expertise to transform your business

Do you own a small or medium-sized Canadian business? You can get a grant and access to expert advice to increase online sales, reduce costs, better manage inventory and more.

Please follow the link below to learn more about the Canada Digital Adoption Program, which grant could be right for you, and other resources and tools that are available.

https://ised-isde.canada.ca/site/canada-digital-adoption-program/en

November 24, 2022

NS Housing Needs Assessment - Request for Support

NS Housing Needs Assessment has launched an Employers Survey and are looking for help to distribute the link to businesses across Nova Scotia. The results from this survey will be used to deepen the understanding of housing needs in all 49 municipalities in Nova Scotia, and the challenges employers are facing due to the housing crisis.

The survey is an engagement tool aimed at deepening the understanding of how housing is impacting the ability for employers to attract and retain employees across the province. The wider Housing Needs Assessment project will provide data and information on current and projected housing needs for each of the 49 municipalities in Nova Scotia, and this survey will help us to better understand the economic impact of housing. The project will help to identify gaps in current and projected housing requirements and ensure that future investments are designed to close those gaps. To learn more about the project, you can visit their website at www.NSHousingNeeds.ca

https://www.surveymonkey.ca/r/NSHNAEmployerSurvey

The survey will be open until December 31st.

November 23, 2022

CRA/ARC: 2023 indexation adjustments are available for individual income tax and benefit amounts

2023 indexation adjustments are available for individual income tax and benefit amounts

Each year, certain personal income tax and benefit amounts are indexed to inflation using consumer price index data from Statistics Canada.

Increases to tax bracket thresholds, amounts for non-refundable credits, and most other amounts take effect on January 1 of each year.

Increases in amounts for certain income-tested benefits (for example, the goods and services tax / harmonized sales tax credit) take effect on July 1, to coincide with the beginning of each program year for payments of those benefits.

To obtain the indexation rates and amounts for the 2020 to 2023 tax years go to Indexation adjustment for personal income tax and benefit amounts.

Stay connected

To find out what’s new at the Canada Revenue Agency (CRA):

Follow the CRA on Facebook

Follow the CRA on Twitter – @CanRevAgency

Follow the CRA on LinkedIn

Follow the CRA on Instagram

Subscribe to a CRA electronic mailing list

Add our RSS feeds to your feed reader

Watch our tax-related videos on YouTube

November 1, 2022

Subject: Destination Canada

Never has the search for qualified skilled talent been as challenging as it is now, and Western REN would like to help you find some great people to fill those vacancies. In a few weeks, they will be participating in Destination Canada Mobility Forum.

Based on experience it is expected to meet many dynamic, qualified people who are keen and ready to come to Canada to work. As part of the Nova Scotia delegation, Western REN participates to attract skilled talent to sectors and jobs within Western Nova Scotia. The main sectors that attracted candidates have included IT/Multimedia, Banking /Finance, Hospitality/Culinary, and skilled trades.

Job offers from Nova Scotia companies will be posted on the Destination Canada website and Western REN will be promoting yours through their in-person and on-line booths. Specifically, they showcase the region’s employment opportunities and compelling life-style advantages.

If you are a business owner and would like to participate or if you have questions/need more information, please reach out any time, please send your current job postings by November 4, to:

Western Regional Enterprise Network

210 Main Street

Yarmouth, Nova Scotia B5A 1C6

We hope can connect some of them to you and together we can help them make Western NS home!

AUGUST 17, 2022

$2,400 Non-Repayable E-Commerce Grant for Nova Scotia Businesses

Are you a Canadian, consumer-facing small business? The Canada Digital Adoption Program can help you adopt new e-commerce tools or give your existing e-commerce presence a boost. Through the Grow Your Business Online grant, your business could have access to:

1. A network of e-commerce advisors to help assess your needs and discover new opportunities

2. Microgrants of up to $2400 to cover the cost of adopting new digital technologies

For more information visit https://www.cbdc.ca/.../canada-digital-adoption-program

March 25, 2022

Nova Scotia Seniors Care Grant

The Seniors Care Grant helps low-income seniors with the cost of household services (like snow removal, grocery delivery, lawn care and small home repairs). Grants are up to $500 for each household. You can apply until 31 May 2022.

To apply for this grant or for more information, go to:

https://beta.novascotia.ca/apply-help-household-costs-seniors-care-grant

and click the ‘Start Now’ button at the bottom of the page.

Eligibility

To qualify for the grant, you need to be 65 or older in 2021 and meet all of the following criteria:

have a household net income of $37,500 or less

live independently in your home (you’re not living with a caregiver, other than a spouse or partner)

own a home (your name is on the property title) or have a residential lease agreement with your name on it

have paid for household services between 1 January 2021 and 30 November 2022

You can only apply once per household. You need to apply by 31 May 2022.

How to apply

Apply online for the grant.

Check the application for details on all required supporting documents.

Submit your completed application and any supporting documents.

If your application is approved, your reimbursement cheque is mailed to you.

How long it takes

It should take 8 weeks to get your reimbursement cheque. It can take longer if more information is needed or if your application hasn’t been filled in correctly. If more information is required to process your grant, we may contact you by email.

January 13, 2022

Government of Canada extends loan forgiveness repayment deadline for the Canada Emergency Business Account

Department of Finance news release:

January 12, 2022 - Ottawa, Ontario - Department of Finance Canada

The Canada Emergency Business Account (CEBA) program has provided interest-free, partially forgivable loans to nearly 900,000 small businesses and not-for-profit organizations to help them navigate the pandemic and remain resilient. However, the Omicron variant has delayed the recovery for businesses in many parts of the country.

Today, the Honourable Chrystia Freeland, Deputy Prime Minister and Minister of Finance, and the Honourable Mary Ng, Minister of International Trade, Export Promotion, Small Business and Economic Development, announced that the repayment deadline for CEBA loans to qualify for partial loan forgiveness is being extended from December 31, 2022, to December 31, 2023, for all eligible borrowers in good standing.

This extension will support short-term economic recovery and offer greater repayment flexibility to small businesses and not-for-profit organizations, many of which are facing continued challenges due to the pandemic. Repayment on or before the new deadline of December 31, 2023, will result in loan forgiveness of up to a third of the value of the loans (meaning up to $20,000).

Outstanding loans would subsequently convert to two-year term loans with interest of 5 per cent per annum commencing on January 1, 2024, with the loans fully due by December 31, 2025.

The government is also announcing that the repayment deadline to qualify for partial forgiveness for CEBA-equivalent lending through the Regional Relief and Recovery Fund is extended to December 31, 2023.

December 20, 2021

Grant Program Offers Support to Businesses Impacted by Latest Restrictions

Economic Development / COVID - 19

December 17, 2021 - 2:03 PM

The Province announced today, December 17, additional support for Nova Scotia businesses impacted by the new provincewide public health restrictions.

The Sector Impact Support Program will provide a one-time grant of up to $7,500 to help small business owners in industries such as restaurants, bars, gyms, live performing arts facilities and recreation facilities.

“With the rise in positive cases and the threat of the Omicron variant, we know these public health restrictions are necessary to help keep Nova Scotians safe,” said Premier Tim Houston. “But we also know these restrictions will have a significant impact on many businesses during what would typically be a busy time of year. That’s why we need to support our business sector and position ourselves for recovery as quickly as possible.”

The Sector Impact Support Program will be funded through the Nova Scotia COVID-19 Response Council. It is expected to cost about $10 million depending on participation.

Applications will open in early January. Eligible businesses can receive the following amounts based on November 2021 gross payroll costs:

· payroll costs between $1,000 and $15,000 – grant of $2,500

· payroll costs between $15,001 and $25,000 – grant of $5,000

· payroll costs between $25,001 or more – grant of $7,500.

Quick Facts:

· the program will be available to: restaurants offering in-person dining service; bars and other licensed drinking establishments; fitness, recreational and leisure facilities including gyms, yoga studios, indoor play areas, arcades, climbing facilities, dance programs and music lessons; boat and walking tours; private museums; rinks and arenas that are not municipally owned; and live performing arts facilities

· businesses must be registered in Nova Scotia as a sole proprietorship, partnership, corporation, society, social enterprise, not-for-profit, charity in business, or other similar organization; have an active CRA Business Number (BN); and have gross revenue of $5 million or less in its most recently completed tax year

· businesses must have had a minimum gross monthly payroll of $1,000 for November 2021 to qualify

· incorporated businesses that operate more than one eligible business establishment under a single corporate entity may claim a rebate for each business establishment

Additional Resources:

More information on support for businesses can be found at: https://novascotia.ca/coronavirus/support/#support-for-business

Information on provincewide restrictions is available at: https://novascotia.ca/coronavirus/restrictions-and-guidance/

October 12, 2021

CEWS, CERS and CRHP programs are winding down. The Canada Emergency Wage Subsidy and the Canada Emergency Rent Subsidy will each see their last period end of October 23, 2021. The deadline to file for this period is April 21, 2022. The Canada Recovery Hiring Program, which was running concurrently with CEWS over the last few periods, will have one more period which ends on November 20, 2021, and must be applied for by May 19, 2022. (For CEWS/CRHP periods 17-21 a calculation is made to determine which program is more beneficial for each recipient and that is what is chosen.)

May 21, 2021

An additional $5,000 grant to assist Nova Scotian small businesses was announced today!

Premier Ian Rankin announced the adjustment of the Provincial Small Business Impact Grant, to offer each business $5000.

Each eligible business which closed during the lockdown will be mailed a $5000 cheque. This grant fund now totals $29 million.

The premier met on Friday with The Nova Scotia Business Improvement Districts Association, an umbrella group consisting of a number of smaller and regional business groups and chambers. The group had been seeking aid for smaller businesses.

More details are expected next week.

From the Nova Scotia webpage https://novascotia.ca/coronavirus/small-business-impact-grant/

Additional $5,000 grant

All recipients approved for the Small Business Impact Grant 3 will receive an additional 1-time grant of $5,000 on top of the revenue-based grant.

If you’ve already received the revenue-based grant, you’ll automatically receive the extra $5,000. You don’t need to reapply.

If you haven’t already received the revenue-based grant, you’ll receive both amounts at the same time.

How to apply

Complete the application form.

If you’re applying for multiple business locations, use the claim form to claim the rebate for your additional locations.

Contact

Small Business Impact Grant Part 3 Program

February 4, 2021

Great free 1 hour webinars by CPA Canada regarding various topics involving small business and finance. These will each be available in either French or English .To register, click on these links:

Register today to get the information you need to help navigate a business through COVID-19 and beyond. Hear from experts on four major topics weighing on the minds of many:

Additional Reporting requirements for 2020 tax year

There are new and specific T4 reporting requirements for all employers for 2020, and a PD27 form to fill out for all employers who claimed the Temporary Wage Subsidy (TWS) or have received the Canada Emergency Wage Subsidy (CEWS).

If White Perkins Associates prepares your T4s, then we will be addressing these extra requirements for you. We request that you please bring your T4 information as soon as possible to allow the extra work these new requirements entail.

If we have prepared or are preparing your CEWS claims, then we will also have filled out the PD27 for your signature.

New Boxes on T4 slips:

If you paid salary or wages between March 15 and September 26, 2020, you must report the amounts using the new codes 57, 58, 59, and 60, depending on the period in which the amounts were paid.

For the 2020 tax year, additional reporting requirements will apply to all employers, and will help the CRA validate payments under the Canada Emergency Wage Subsidy (CEWS), the Canada Emergency Response Benefit (CERB), and the Canada Emergency Student Benefit (CESB).

In addition to reporting employment income in Box 14 or Code 71, use new other information codes when reporting employment income and retroactive payments in the following four periods:

Code 57 – Employment Income – March 15 to May 9

Code 58 – Employment Income – May 10 to July 4

Code 59 – Employment Income – July 5 to August 29

Code 60 – Employment Income – August 30 to September 26

Eligibility criteria for the CERB, CEWS, and CESB is based on employment income for a defined period. The new requirement means employers should report income and any retroactive payments made during these periods.

Example

If you are reporting employment income for the period of April 25 to May 8, payable on May 14, use code 58.

PD27 form

If you are eligible to take advantage of the Temporary Wage Subsidy (TWS) or have received the Canada Emergency Wage Subsidy (CEWS), you need to fill out and submit Form PD27, 10% Temporary Wage Subsidy Self-Identification Form for Employers, for each of your payroll program (RP) accounts. The CRA will use the information from your Form PD27 to reconcile the TWS on your payroll program (RP) accounts.

You are encouraged to provide all the information requested on Form PD27 and submit it to the CRA as soon as possible to avoid receiving a discrepancy notice at the end of the year. You do not need to wait until you file your T4 information return.

You need to complete and submit Form PD27 to the CRA if you are eligible to take advantage of the TWS and:

· you already reduced your remittances

· you intend to reduce your remittances (the form will help you calculate your eligible TWS amount)

· you claimed the CEWS and, as a result, need to confirm on Form PD27 the amount of the TWS you are taking advantage of (refer to Line F of your CEWS application).

Sources:

https://www.canada.ca/en/revenue-agency/services/subsidy/temporary-wage-subsidy/tws-reporting.html

January 19, 2021

Local bookkeeping career opportunity!

Check out the details either on the White Perkins Facebook page https://www.facebook.com/wpacpa or here on our website at https://wpacpa.ca/local-careers. If you are interested in the position, please forward your resume to andrew@wpacpa.ca by January 29, 2020.

January 5, 2021

Canadian Agricultural Partnership Webinar

January 14, 2021

Time: 12:00pm Atlantic

A great information session for anyone involved or interested in agriculture:

"Agriculture and Agri-Food Canada invites you to participate in a free webinar. This webinar is for people who are new to the AgriStability and AgriInvest programs or have not yet joined the programs but would like to learn more.

Join us on January 14, 2021 at 11:00 a.m. Eastern (10 a.m. Central), for this online webinar to hear about program basics and how you may benefit from participating in AgriStability and AgriInvest.

During this webinar you will be able to ask questions related to the topics discussed and receive responses from Agriculture and Agri-Food Canada officials."

To find out more or register for the webinar: https://zoom.us/webinar/register/WN_CqJeRzoXSmy02yARpcjoCQ

December 15, 2020

News release- Department of Finance Canada

Small businesses continue to face challenges and uncertainty during the COVID-19 pandemic and the government is providing support to ensure they can stay in business.

Since the spring, the Canada Emergency Business Account has helped almost 800,000 small businesses and not-for-profits in Canada. Today the Deputy Prime Minister and Minister of Finance, the Honourable Chrystia Freeland, announced the expansion of the Canadian Emergency Business Account (CEBA).

Starting on Friday, December 4, 2020, eligible businesses facing financial hardship as a result of the COVID-19 pandemic are able to access a second CEBA loan of up to $20,000 – on top of the initial $40,000 that was available to small businesses.

Half of this additional financing, up to $10,000, will be forgivable if the loan is repaid by December 31, 2022.

This means the additional loan effectively increases CEBA loans from the existing $40,000 to $60,000 for eligible businesses, of which a total of $20,000 will be forgiven if the balance of the loan is repaid on time.

As announced in the Fall Economic Statement, the application deadline for CEBA has also been extended to March 31, 2021.

To apply, eligible businesses and not-for-profits need to contact the financial institution that provided their initial CEBA loan and provide the appropriate information and documentation.

September 28, 2020

Canada Revenue Agency had extended the payment due date for current year individual, corporate, and trust income tax returns, including instalment payments, from September 1, 2020, to September 30, 2020. Penalties and interest will not be charged if payments are made by the extended deadline of September 30, 2020. This includes the late-filing penalty as long as the return is filed by September 30, 2020.

July 29, 2020

Below are 2 links to recent information released regarding payment of tax owing and a redesign of the Canada Emergency Workers Subsidy:

Good news for those owing income tax:

"Anyone who owes the federal government taxes will now have until the end of September to pay. The Canada Revenue Agency says the payment deadline has been moved to Sept. 30 for individuals, corporations and trusts that had various deadlines through the month. Penalties and interest on owed taxes on a 2019 return will accrue if payments aren't made by the new deadline." See more details in the link below.

https://www.cbc.ca/news/business/cra-tax-payment-1.5664805

The federal government has extended the CEWS to subsidize wages up to December 19, 2020. They have also redesigned the CEWS program details to be accessible to employers with a revenue decline of less than 30% AND a top-up subsidy of up to an additional 25% for employers most adversely affected by the pandemic. See more information in the following link:

July 22, 2020

July 17, 2020

We now invite our personal tax clients who have not yet picked up your copies of your 2019 tax returns and related documents to please come and do so.

Our doors are now open from 8:30 to 5 pm daily, and we are happy to safely welcome you.

May 15, 2020

Federal assistance for fish harvesters announced

Click on the top button below to watch Justin Trudeau’s May 14th announcement regarding assistance for fish harvesters navigating their way through the stormy seas of 2020. Click on the one under it for an article which provides more detailed information on the federal government programs announced for fish harvesters yesterday.

May 8, 2020

Considerations as you prepare to reopen your business:

Click below for an excellent article from the Business Development Bank of Canada (BDC) which summarizes the key factors that need to be seriously considered by business owners as you reopen your business. The future will be different from the past and owners need to forecast and prepare for the new normal, and how this affects supply chains, customer demands and most importantly cash flow.

May 4, 2020

As we head into May and are able to cautiously enjoy more of our outdoor space, we hope that you and your families are well. At this time, we want to remind everyone of the extended tax deadlines this year.

The deadline for personal tax returns (non-self-employed) was extended from April 30, 2020 to June 1, 2020.

The deadline for personal tax returns for self-employed individuals and their spouses is still June 15, 2020 and was not extended.

However:

The payment date for 2019 taxes owing has been extended to September 1, 2020.

For more information on these, corporate returns and other types of 2019 tax returns, go to:

https://www.canada.ca/en/revenue-agency/campaigns/covid-19-update/covid-19-filing-payment-dates.html

April 26, 2020

Our Canada Emergency Wage Subsidy Calculator and the instructional video on its use are up! Find them here:

April 24, 2020

We wish to thank all those who participated in this morning's webinar on the Canada Emergency Wage Subsidy which we presented in partnership with Yarmouth Chamber of Commerce. We hope that you found this informative and please contact us if you have any follow up questions.

Also watch for our CEWS calculator which we will be releasing shortly.

We wish to thank all those who participated in this morning's webinar on the Canada Emergency Wage Subsidy which we presented in partnership with Yarmouth Chamber of Commerce. We hope that you found this informative and please contact us if you have any follow up questions.

Also watch for our CEWS calculator which we will be releasing shortly.

April 23, 2020

Bookkeeping position available.

Click below for a career opportunity with a well established local group of family owned companies involved in the buying, selling, manufacturing and processing of seafood.

April 22, 2020

We are presenting an online Wage Subsidy Seminar

Our firm has partnered with The Yarmouth & Area Chamber of Commerce to bring a one hour presentation on the Canada Emergency Wage Subsidy (75% wage subsidy). Our presentation will be about 40 minutes long with some time for questions at the end.

We will review the premise of the wage subsidy, who qualifies, how it is calculated, and how to apply.

When: Friday, April 24 at 9:30 am

Where: Zoom webinar

The webinar will be conducted over Zoom and we ask that you pre-register as space is limited to 100 participants. Please register at: http://events.constantcontact.com/register/event?llr=rftfbnvab&oeidk=a07eh1vp0nt7aace916

We hope to (virtually) see you there!

April 20, 2020

Over the last week there were significant developments regarding the 75% wage subsidy and CERB. We have prepared the following document to help with understanding and working through the program.

We will continue to keep you apprised of any important updates to any of CRA's COVID-19 programs.

We understand that these programs, in particular the wage subsidy, are complex. If you have any questions, please do not hesitate to contact Andrew, Jennifer, or Rob.

COVID-19 75% wage subsidy background

On April 11, 2020, Parliament met to introduce and quickly pass Bill C-14 – COVID-19 Emergency Response Act, No. 2 (https://www.parl.ca/DocumentViewer/en/43-1/bill/C14/royal-assent). Prime Minster Justin Trudeau first announced the 75% wage subsidy weeks ago. Bill C-14 addresses the promised subsidy by introducing subsection 125.7 to the Income Tax Act as well as amends several other sections of the Income Tax Act and the Financial Administration Act. Subsection 125.7 of the Income Tax Act addresses how the subsidy will work. The amendments to the Income Tax Act are complex, which we anticipate will make this subsidy difficult for most entities to understand.

Below, are parts of the Bill you need to be aware of:

1. Eligible entity;

2. Qualifying period and prior reference period;

3. Qualifying revenue;

4. Eligible employee;

5. Eligible remuneration;

6. Baseline remuneration;

7. Subsidy calculation;

8. Adjustments to calculations;

9. Making up the difference in pay;

10. Information that may be communicated;

11. How to apply;

12. How subsidies are paid;

13. Combatting abuse;

14. Combining CEBA loan program to increase effectiveness of CEWS; and

15. The Canada Emergency Response Benefit and CEWS.

Eligible Entity

An eligible entity is defined under subsection 125.7(1) of the Income Tax Act. This includes taxable corporations, individuals, registered charities, most not-for-profits, and partnerships. It does not include municipalities, public service bodies, schools, or hospitals. The entity must have had a business number and a payroll remittance account registered with CRA on March 15, 2020.

Qualifying periods and prior reference periods

Under subsection 125.7(1) of the Act, an entity can apply for a 75% subsidy in three defined periods. Applications can only be made if an eligible entity meets the criteria setout in the definitions under subsection 125.7(1). In order to apply for each period, the eligible entity must have had prescribed declines in revenue compared to a prior reference period.

Entities will be allowed to choose one of two methods for choosing a prior reference period:

1. By comparing revenue to the same month in 2019 (e.g. revenue in April 2020 compared to revenue in April 2019); or

2. By comparing revenues to average revenues for January and February 2020 (e.g. revenues in April 2020 to the average revenue from January and February 2020).

An eligible entity should be careful in choosing their prior reference period as they will be required to use this reference period for the remainder of the subsidy. For example, if an entity chooses to compare March 2020 revenue to the average of January and February 2020, they must compare all months going forward to the average revenue of January and February 2020.

The qualifying periods and criteria are as follows:

1. March 15, 2020 – April 11, 2020 – the eligible entity must have had a 15% decline in revenue for the month of March 2020 compared to the prior reference period (March 2019 or average of January and February 2020);

2. April 12 – May 9, 2020 – the eligible entity must have had a 30% decline in revenue for the month of April 2020 compared to the prior reference period (April 2019 or average of January and February 2020);

3. May 10 – June 6, 2020 – the eligible entity must have had a 30% decline in revenue for the month of May 2020 compared to prior the reference period (May 2019 or average of January and February 2020);

Subsection 125.7 allows the Minister to add additional qualifying periods without parliamentary approval up to September 30, 2020. Given announcements from the government on the time frame of social distancing, we anticipate this will be extended right through September 30, 2020.

A surprising unannounced addition to subsection 125.7, is that if an eligible entity meets the criteria for one month, they are deemed to qualify the following month. This is a welcome addition, given the payment periods for the subsidy cover two months.

Qualifying revenue

Another surprising aspect of subsection 125.7 is that it allows businesses to choose to use either the cash or accrual method in determining the decline in revenue. This may be crucial for a business that has not seen a decline in revenue; however, is suffering a cash crunch as they are unable to collect receivables. Like with the choice for reference period noted above, once a business makes its decision it cannot change. For example, if an eligible entity determines the cash method is advantageous for March and April, it cannot switch to the accrual method for May.

Despite the choice of using accrual or cash method, there is a requirement that revenue be accounted for in a manner consistent with the entity’s “normal accounting practices” (subsection 125.7(4) of the Act).

Qualifying revenues will exclude extraordinary items and amounts derived from persons or partnerships not dealing at arm’s length. This may be an area of contention and may cause confusion among entities as the terms “extraordinary revenue” is not well defined in accounting principles. This is a problem because accounting principles are generally designed to be fluid and open to professional judgement.

Please be aware that under subsection 125.7, the Government has included a number of provisions to prevent manipulation of revenue, please see anti-abuse measures below.

Eligible employee

Subsection 125.7(1) defines an eligible employee as “an individual employed in Canada by an eligible entity in the qualifying period, other than an individual who is without remuneration by the eligible entity in respect of 14 or more consecutive days in the qualifying period.”

The final part of that definition is crucial. If an employee is hired or rehired 14 days after the start of a qualifying period, their wages will not be covered by the subsidy. This means that for any businesses looking to hire or rehire for the April 12 – May 9 period, they must have those employees rehired by April 25. If rehired on April 26 or later, they will not be remunerated for 14 consecutive days, meaning their pay for April 26 – May 9 will not be covered, even if the entity otherwise qualifies for the subsidy.

Non-arm’s length employees

It should be noted that any non-arm’s length employee not on the payroll as of March 15, 2020, will not be eligible for the subsidy. This is to prevent businesses from adding family members to the payroll, that would otherwise have not been active in the businesses.

Eligible remuneration

Salaries, wages, commissions, and taxable benefits (except for personal use of a corporate vehicle) are all considered eligible remuneration under subsection 125.7(1). Dividends, retirement allowances, stock options, and any form of severance payment are not eligible for the CEWS.

Baseline remuneration

An important concept outlined in subsection 125.7(1) is the definition for baseline remuneration. This plays an important role in the subsidy calculation below. Baseline remuneration is the average weekly eligible remuneration, paid to the eligible employee, by an eligible entity, from January 1, 2020 to March 15, 2020, excluding any period of seven or more consecutive days, where the employee was not remunerated.

For example, if an eligible entity paid an employee $8,000 from January 1 through March 15, 2020; however, during this time the employee took seven days unpaid leave, the average weekly pay would be $1,035 [$8,000*(67 days worked/74 days in period)/7 days in a week].

Subsidy calculation

Subsection 125.7(2) defines the wage subsidy calculation. The subsidy calculation is the greater of:

The least of:

-75% of eligible remuneration paid to eligible an employee in respect, of that week;

-$847; and

-If the eligible employee does not deal at arm’s length with the qualifying entity in the qualifying period, nil;

and

The least of:

-The amount of eligible remuneration paid to an eligible employee, in respect of that week;

- 75% of the baseline remuneration in respect of the eligible employee determined for that week; and

-$847

In effect, this calculation separates employees into three pools:

1. pre-existing arm’s length employees;

2. new hire arm’s length employees; and

3. non-arm’s length employees.

We’ll run through these with several examples.

Example 1 – pre-existing arm’s length employee

Hank Hill has been employed by Strickland Propane for over 30 years. He is not related to the owner, Buck Strickland. Until March 15, 2020, he was earning $800/week; however, due to the downturn from COVID-19, Hank’s weekly wage was reduced to $700/week. The subsidy available to Strickland Propane for the first claim period, would be calculated as the greater of:

The least of:

-75% of eligible remuneration paid to an eligible employee, in respect of that week = $700 * 75% = $525;

-$847; and

-If the eligible employee does not deal at arm’s length with the qualifying entity in the qualifying period, nil;

and

The least of:

- The amount of eligible remuneration paid to an eligible employee, in respect of that week = $700;

-75% of the baseline remuneration in respect of the eligible employee determined for that week = $800 * $75 = $600; and

-$847.

Since Hank is at arm’s length from Strickland Propane, the least of the first section is $525 or 75% of his current pay. The least of the second portion of the calculation is $600, or $75% of the baseline remuneration. Since $600 is greater than $525, the subsidy Strickland Propane will receive for Hank is $600. In effect, the subsidy is covering 85.7% of Hank’s current weekly wage.

Example 2 – new arm’s length employee

Donna was hired into the accounting department of Strickland Propane on April 25, 2020 and was put on payroll that day. This puts Donna into the second claim period, which runs from April 12 – May 9. Since she was not on the payroll from April 12 – April 24, she is 13 days without remuneration, thus will qualify. Donna’s pay is $600/week. The subsidy available to Strickland Propane for the second claim period would be calculated as the greater of:

The least of:

-75% of eligible remuneration paid to an eligible employee in respect of that week = $600 * 75% = $450;

-$847; and

-If the eligible employee does not deal at arm’s length with the qualifying entity in the qualifying period, nil;

and

The least of:

-The amount of eligible remuneration paid to an eligible employee, in respect that week = $600;

-75% of the baseline remuneration in respect of the eligible employee determined for that week… since Donna was hired after March 15, she does not have a baseline remuneration, thus this is deemed nil; and

-$847.

Where the second part of the calculation has a nil calculation, we default to the first part of the calculation. This means the subsidy for Strickland Propane for Donna in the second period is $450/week.

Example 3 – non-arm’s length employee

Since day 1, Buck has managed Strickland Propane; however, he has only taken dividends as his remuneration. In order to take advantage of the subsidy, Buck decided to put himself on payroll at $1,129/week in order to maximize his potential claim. He went on payroll March 16, 2020. The subsidy is calculated as the greater of:

The least of:

-75% of eligible remuneration paid to an eligible employee in respect of that week = $1,129 * 75% = $847;

-$847; and

-If the eligible employee does not deal at arm’s length with the qualifying entity in the qualifying period, nil;

and

The least of:

-The amount of eligible remuneration paid to an eligible employee, in respect that week = $1,129;

-75% of the baseline remuneration in respect of the eligible employee determined for that week… since Buck went on payroll after March 15, he does not have a baseline remuneration, thus this is deemed nil; and

-$847.

Since Buck does not deal at arm’s length from the Company the first part of the calculation is nil. Where he did not go on payroll until March 16, the second part of the calculation is nil. Therefore, no subsidy is available for Buck.

The lesson to be taken from this example is that non-arm’s length employees only qualify for the subsidy, if they were on the payroll on March 15 or earlier.

Adjustments to calculations

Subsection 125.7(2) has several adjustments that may affect the subsidy for an employee:

-The CEWS is reduced by any amounts claimed by the employer, under the 10% wage subsidy. For example, if under example #1 above, Strickland were to have claimed the 10% subsidy for Hank in the first cycle, their CEWS payment would be reduced by $70/week ($700 * 10%);

-If the employee is receiving benefits under the EI work-sharing benefit, the amounts received by that employee reduces their CEWS; and

-For any employees on leave with pay in a particular week, CEWS will cover the employer portion of EI and CPP costs for the employee. This is not limited to the cap of $847.

We suspect the final adjustment is the one that will be most important to most employers. The government is encouraging employers to put their employees back (or keep them) on payroll. Due to COVID-19, restrictions and the closing of employers, many Canadians are not able to work. Keeping/returning people to payroll allows them to better manage their cash flow as CEWS will put more money into Canadians’ pockets than EI or CERB. It also gives Canadians assurance that they will have a job to return to as physical distancing restrictions are eased. To further encourage employers to keep employees, or rehire them, this final adjustment allows employers to have the employer portion of EI and CPP expense fully covered, if the employee is told to stay home on leave with pay. Depending on the employer, this can be a significant cash savings.

Making up the difference in pay

From the first day this subsidy was announced, the Federal Government was keen to encourage all employers to make up the difference not covered under the wage subsidy; however, no measures were announced indicating that it would be required. Bill C-14’s amendments to the Income Tax Act do not add any provisions that require employers to top up employee wages.

Effectively, when this is combined with the ability to have EI and CPP expenses covered for employees that are still being paid but not working, it means that if an employee has their wage reduced to 75% or below their baseline remuneration they can remain on the entity’s payroll with no net cash effect to the entity (other than any worker’s compensation obligations).

The Federal Government is still actively encouraging employers to make up the difference.

Information that may be communicated

Bill C-14 also adds subsection 241(3.5) which allows the Minister to communicate or otherwise make available to the public, in any manner that the Minster considers appropriate, the name of any person or partnership that makes an application under subsection 125.7.

This addition to the Act gives a lot of power to the Federal Government both for propaganda purposes (to tell Canadians which companies in their neighborhood were able to keep people employed because of CEWS) and to potentially “name and shame” entities they perceive to be abusers.

We encourage anyone applying for CEWS that is not able to top up their staff’s wages that they maintain a journal or schedule and document why they were unable to make up the difference (e.g. cash flow documentation) so they may show any CRA auditor and stay off any potential “name and shame” list. Proper documentation will also help to protect employers in the event of a CRA audit and to avoid concerns or allegations that have abused the CEWS.

How to apply

Eligible employers will be able to apply for the CEWS through CRA’s My Business Account. We strongly recommend that businesses get access through My Business Account in advance of the applications opening up in order to avoid delays in obtaining the CEWS. More details are not available at this time; however, CRA is promising that more details will be made available shortly.

How subsidies are paid

Subsection 127.5(2) refers to the wage subsidy as an overpayment. Essentially, the application for CEWS generates a credit to the payroll account, which the Act is considering an overpayment. The Income Tax Act allows the refund of overpayments of tax. The refund of these overpayment comprises the subsidy payments.

Bill C-14 adds subsection 164(1.6) to the Income Tax Act. This gives the Minister the ability to refund an overpayment in the payroll remittance account resulting from subsection 125.7(2) (the CEWS calculation) at any time during the current taxation year. This is different from other refund provisions in the Act, which do not allow the Minster to issue a refund until after the taxation year has passed.

Subsection 164(2.01) has also been added to prevent refunds from subsection 164(1.6) to be allocated to other accounts with CRA that may be in arrears, such as HST/GST accounts or corporate tax accounts. In other words, Bill C-14 introduces wording into the legislation that requires CRA to get money into the hands of entities quickly.

Deadline

Application for all payment periods must be submitted by October 20, 2020. This late application deadline is something that entities without cashflow concerns can, and should, take advantage of—where possible. By delaying an application, an eligible entity can wait and see what prior reference period option is best for them to use and determine whether cash accounting or and accrual accounting is optimal. This gives these entities the opportunity to maximize the potential of the CEWS.

Combatting abuse

We’ve been receiving questions from clients as to how the government is going to be preventing abuse of the CEWS. Clearly this is a program where there is room for ambiguity and interpretation (as discussed above) and since money is being paid quickly, the program is a prime target for abuse. Unsurprisingly, Bill C-14 adds measures to the Income Tax Act to combat abuse of the program:

-If an employer is found to have engaged in a transaction that violates 125.7(6), subsection 163(2.901) has been added to the Income Tax Act which institutes a 25% penalty on the entire subsidy paid for that qualifying period;

-Subsection 163(2)(h) has been added to the Act to include subsection 125.7(2) subsidies, where CRA can apply gross negligence penalties, which amount to 50% of the CEWS. This means if the entity applied under 125.7(2) that they know to have been, or ought to have known, was false, they can be subject to a 50% penalty. This is on-top of the 25% penalty if CRA’s application of the penalty arose due to a violation of 163(2.901) noted in the point above;

-Subsection 125.7(1) requires that the individual principally responsible for the financial activities of the eligible entity attest that the application is complete and accurate in all material respects. This measure is important relating to some of the penalties detailed below, but also for the potential “name and shame” noted above;

-The definition of eligible remuneration in subsection 125.7(1) excludes any payment made to employees where the payment can be reasonably expected to be repaid or returned to the employer, directly or indirectly, in any manner whatsoever. This prevents someone from being paid an increased wage, only to then have to return it to the employer (e.g. payment of goods or services not provided to the employee), whereby the only purpose of that payment was to increase the subsidy;

-The eligible remuneration definition also excludes payments made to an employee where it is reasonably expected that the wage will return to the baseline after the qualifying period. This prevents an employee and employer agreeing to give the employee a raise during the CEWS period, only to return the employee back to their regular pay once the CEWS ends;

-As noted above, the calculation under 125.7(2) prevents non-arm’s length employees from being added to payroll in order to maximize the subsidy;

-Also as noted above, the entity must have a payroll number as of March 15, 2020. This prevents employers that have never had payroll to suddenly add payroll simply to qualify for the wage subsidy;

-Subsection 125.7(5)(b) deems that if an employee is receiving remuneration from two qualifying entities that are not dealing at arm’s length, the subsidy received for that employee shall not exceed the amount that would arise if the subsidy were paid to only one qualifying entity. This prevents an employee from being paid by two related businesses in order to double dip;

-Subsection 125.7(6) puts a purpose test into transactions between related entities, whereby if the sole purpose of the transaction is to reduce revenue during the qualifying period, CRA will deem that the revenue for the qualifying period and reference period are equal. This means that if the entity engages in even one transaction that CRA concludes is simply to reduce revenue, then the entire qualifying period is not eligible, even if the entity would have qualified if that transaction was ignored;

-If an employer is found to have engaged in a transaction that violates 125.7(6), subsection 163(2.901) has been added to the Income Tax Act which institutes a 25% penalty on the entire subsidy paid for that qualifying period;

-Subsection 163(2)(h) has been added to the Act to include subsection 125.7(2) subsidies, where CRA can apply gross negligence penalties, which amount to 50% of the CEWS. This means if the entity applied under 125.7(2) that they know to have been, or ought to have known, was false, they can be subject to a 50% penalty. This is on-top of the 25% penalty if CRA’s application of the penalty arose due to a violation of 163(2.901) noted in the point above; and

-As noted, a couple of times previously, the Minister has the ability to communicate names of participating entities in the CEWS to the public in any manner they deem appropriate, which again, can be a “name and shame” campaign.

Finally, while not noted in Bill C-14, we anticipate the CEWS will be heavily audited by CRA in the future. It is crucial that all entities making applications under the program fully document their decisions to hire and rehire employees, previous wages, current wages and any reason for increase or decrease in the remuneration paid. Entities must also document decisions made in determining reference period revenue and qualifying period as well as accounting policies adopted to determine said revenue.

Combining CEBA loan program to increase effectiveness of CEWS

The Canadian Emergency Business Account (CEBA) provides an interest free, no service fee, line of credit of up to $40,000 to qualifying entities, which is to be used for cash flowing operating costs—including payroll. If the line of credit is fully repaid by December 31, 2022, the Federal Government will forgive 25% (maximum $10,000) of the line of credit balance utilized by the entity.

Since the CEBA can be used for payroll, an entity that qualifies for CEWS can combine these two programs to cashflow 100% of wages costs and use the 25% forgivable portion to cover any wages paid not covered by the subsidy. This is accomplished by using the forgiven portion of the line of credit to pay the amounts of employee wages not covered by the CEWS.

Using this tactic provides security to entities by covering the totality of their employee wages and protect their cash flow. This allows the entity to not only survive this crisis, but be prepared for the eventual ramp up in operations.

The Canada Emergency Response Benefit and the CEWS

On April 15, 2020, the Federal Government announced further changes to the Canada Emergency Response Benefit (“CERB”). The CERB will payable eligible Canadians up to $2,000 for each four-week payment period up to six weeks total.

The changes announced allow anyone who earns less than $1,000 during a four-week period to also apply for the CERB. Previously, anyone on CERB was not able to earn any employment or self-employment income. The effect of this change is it allows lower income Canadians, or those that have had their wages slashed due to COVID-19, to effectively earn up to $3,000 during a four-week payment period.

For employers, this change does not affect the ability for that employee to still be covered under CEWS; however, employers must still remember the rule relating to 14 or more consecutive days without remuneration still exists.

If you are an employer that has employees that are already earning more on CERB and do not want to come back to work on reduced hours or for occasional shifts, you can still rehire that individual and pay them less than $1,000 every four-weeks and claim CEWS. This will allow you to put more money in the hands of your staff at little-to-no cost to you.

Please note that if any employees are earning more than $1,000 per four-week period, they will not be eligible for the CERB. Employers should consider highlighting this to employees, especially rehired staff, as Bill C-14 introduced language to the Income Tax Act that allows CRA to compare the names of CERB and CEWS recipients. CRA is likely to use this ability to identify Canadians that have inappropriately applied for CERB.

Conclusion

Bill C-14 is a complex and far reaching set of legislation. It has a number of complicated measures that mean it will be difficult for most entities, especially small owner-manager operations and small not-for-profits/charities, to understand and fully grasp the requirements of the legislation.

Despite the Federal Government advertising this subsidy program as a 75% reimbursement of wages, CEWS can cover up to 100% of remuneration paid to employees. Thus, despite the complexities of the legislation, the CEWS is a program that any and all qualifying entities should consider.

Where any doubt or uncertainly lies, it is important for all eligible entities to discuss with their accounting professionals the various eligibility criteria and as to how the calculation will apply to each employee and ultimately affect the subsidy received.

Should you have any questions or concerns about the CEWS, the related legislation, or the application process, please do not hesitate to contact us. We are more than happy to help.

All the best to you and your family,

Jennifer White, CPA, CA

Andrew Perkins, CPA, CA

Robbie Fuller, PBA

April 9, 2020

The Canada Emergency Wage Subsidy and what it means for Canadian employers

Click on the Government of Canada link below for comprehensive information on all aspects of the subsidy, and please contact us if you have any questions.

https://www.canada.ca/en/department-finance/economic-response-plan/wage-subsidy.html

April 8, 2020

During today's press conference, the Prime Minister announced several important changes relating to the 75% wage subsidy as well as a couple of other announcements that may be of importance to you. Following is a summary of these announcements.

If you have any questions or would like to discuss any of these announcements further, please do not hesitate to reach out to us.

Prime Minister April 8 announcements

75% wage subsidy

Several changes were announced today by the Prime Minister for the 75% wage subsidy:

The test for the drop revenue for March has been relaxed from 30% down to 15% to reflect that covid-19 shutdowns occurred mid-month;

Not-for-profits can now include or exclude government funding in their analysis of decline in revenue;

Fast-growth companies can choose to use January-February as a reference point instead of March 2019; and

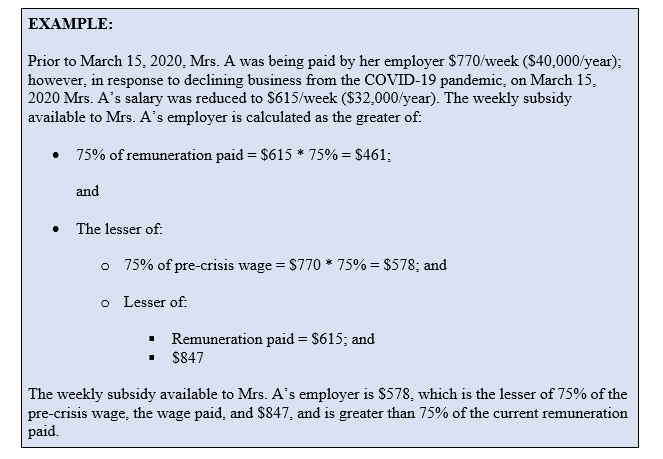

The subsidy calculation has been modified to pay the greater of 75% of the amount paid and the lesser of 75% of pre-crisis wage and the amount paid up to $847.

What the final point means, is that if you have staff that have had their pay reduced below their pre-COVID-19 wages, the effective subsidy paid may be greater than 75%.

In effect, this calculation can result in 100% of an employee’s wage being covered by the subsidy if their pay has been reduced to 75% of the pre-crisis amount and their weekly pay is equal to or less than $847/week.

Canadian Emergency Response Benefit

Solutions are being developed for those not yet covered under Canada Emergency Response Benefit, including part-time workers, students who are about to join the job market, etc.

Summer Students

For businesses and organizations who hire summer students under the Canada Summer Jobs Fund, the government will cover 100% of the summer student hired wage costs. Further, the job placement period covered will be extended to the winter given the placement will begin late. This also will cover part-time staff and full-time staff. In this regard, MP’s will be reaching out to businesses and organizations encouraging them to hire summer students.

The following update relates to the provincial programs for workers and small businesses announced yesterday:

April 2, 2020

Today, Premier McNeil announced two financial measures to help those in need get through the next few weeks.

Worker Emergency Bridge

This is a one-time $1,000 payment available to those who do not qualify for EI but were laid off or had to leave work due to COVID-19. The one-time payment will be paid out immediately to bridge the time lag between now and when individuals receive their first Federal Canada Emergency Benefit cheque.

Small Business Impact Grant

This is another one-time grant up to a maximum of $5,000 available to small businesses to assist them with cash-flow to help them survive this pandemic caused crisis.

Who qualifies?

All Nova Scotia resident small businesses.

Does a brand-new start up company qualify?

Yes. As Premier McNeil stated, “we do not want to leave anyone behind.”

How do you calculate the grant that your business qualifies for?

The grant is based on 15% of gross revenues of either April 2019 or February 2020, again to the maximum benefit of $5,000.

What are the restrictions of use of these funds?

There are none. The grant can be used by the small business for any purpose.

How do you apply or get more information on this grant?

Go to: https://novascotia.ca/coronavirus/

The government is beginning to accept applications for this next week. This link will provide details regarding where and how to apply for this grant.

April 1, 2020

White Perkins summary of the Government of Canada’s COVID-19 Economic Response Plan

As the saying goes, “Cash is King.”

These are unprecedented times, with uncertainty as to the future. Our generation has never lived through anything like this; however, unlike past generations we have social platforms in place and a government that is taking drastic steps to keep cash flowing through businesses. We want to ensure that you are aware of these programs that are available to assist you and hope to answer some questions that you might have.

For businesses there are several programs that the government has announced:

Payroll wage subsidy:

For small employers, a 10% wage subsidy; and

For qualifying employers, a 75% wage subsidy;

Access to non-interest-bearing lines of credit (“Canada Emergency Business Account”) up to $40,000, and if repaid prior to December 31, 2022 will have the first $10,000 forgiven;

Deferral of payment due date of HST remittances and duty taxes until June, allowing businesses to utilize this cash for overhead costs;

Deferral of requirement to pay corporate taxes until August 31, 2020; and

Government support provided to financial institutions to lend money to those in need to help them bridge these times.

For individuals who have been laid off or are self-employed there is the Canada Emergency Response Benefit (CERB).

We will walk through details and address questions of each. Other measures announced by the Federal Government include:

Filing deadline extensions for T1’s, T3’s, T1135’s, and non-profit T3010;

In concert with this, due dates of taxes owing have been deferred to August 31, 2020, again allowing individuals and businesses to use this cash to help them get through these times; and

The Bank of Canada has lowered their rate to 0.25%

Canada Emergency Response Benefit (CERB)

How does this differ from the normal EI program?

This program is available to those who:

Residing in Canada, who are at least 15 years old;

Who have stopped working because of COVID-19 or are eligible for Employment Insurance regular or sickness benefits:

Who had income of at least $5,000 in 2019 or in the 12 months prior to the date of their application; and

Who are or expect to be without employment or self-employment income for at least 14 consecutive days in the initial four-week period. For subsequent benefit periods, they expect to have no employment income.

The income of at least $5,000 may be from any or a combination of the following sources: employment; self-employment; and maternity/parental benefits under the Employment Insurance program. Owners of companies and self-employed individuals can apply if they meet the above criteria.

How do I apply?

You can apply on-line. It is recommended the easiest and fastest way to access benefits is through your My Account at CRA. There will be a sign-up link and the application process is supposed to be quick and simple.

Starting April 6, 2020, you can apply for the Canada Emergency Response Benefit. Until then, Canadians who are eligible for Employment Insurance and who have lost their job can continue to apply for Employment Insurance.

How do I know whether to apply for EI benefits or the Canada Emergency Response Benefit?

If you have stopped working because of COVID-19, you should apply for the Canada Emergency Response Benefit, whether or not you are eligible for Employment Insurance. The Benefit is available for the period from March 15, 2020 to October 3, 2020.

Starting April 6, 2020, there will be a single portal to assist you with the application process. Until then, Canadians who are eligible for Employment Insurance and who have lost their job can continue to apply for Employment Insurance.

If you applied for EI regular or sickness benefits on March 15, 2020 or later, your claim will be automatically processed through the Canada Emergency Response Benefit.

In addition, for other EI benefits, including maternity, parental, caregiving, fishing and work sharing, you should also continue to apply.

What if I already applied for EI?

As noted above, you do not need to do anything. Allocations for EI on or after March 15, 2020 will automatically be processed through the CERB.

What if there are several people in my house that are not working due to Covid-19, can each apply for the CERB?

Yes, and each will receive $2,000 per month.

Can I receive the CERB and my employer receive the wage subsidy?

No. However, until you are rehired and your employer has applied for the wage subsidy you can receive the CERB. Once re-hired, you no longer qualify for the CERB.

Is the CERB taxable?

Yes.

Payroll Subsidies

How does this work? How does the 10% subsidy differ from the 75% subsidy? How do you qualify for the 75% rebate?

The 10% payroll rebate is available to all small businesses.

· This is also eligible to non-profit organizations, registered charities, and Canadian controlled private corporations, who have a payroll account set up with CRA and are paying payroll. Note that large companies, who with an associated group have taxable capital of $15 million do not qualify under this program;

· The subsidy is 10% of the remuneration paid to employees between March 18, 2020 to June 20, 2020, up to a maximum of $1,375 per employee and a maximum of $25,000 per employer;

· Associated companies each individually qualify for this subsidy;

· The subsidy is to be received by reducing the payroll remittance the employer remits;

· Important to note that employers are NOT ALLOWED to reduce the remittance of CPP and EI to be sent. In other words, the subsidy comes off the taxes withheld; If the taxes withheld are not sufficient, you can offset remittances after June until the full qualifying subsidy is received; and

· Even if you do not reduce the remittance for the months above, you can request the subsidy amount entitled to the organization, to be paid to you at the end of the year or transferred to the next year’s remittance.

The 75% payroll subsidy is available to ALL qualifying businesses (including proprietorships and partnerships), charities, and not-for-profit organizations. To qualify, you must:

· Be able to demonstrate a decline in revenue of 30% due to COVID-19. This is done by comparing revenue from March, April, or May to the same period of the prior year; and

The 30% revenue decline will be tested monthly. Please note that the March benefit will be retroactive to March 15; however, the revenue decline test is based on the entire month of March.

What if you are a start-up company and your sales have been growing but then completely dropped off as you had to close your doors. Will you qualify?

Given your sales have been lost due to COVID-19 and you had to suspend your business, yes you qualify.

How does the 75% payroll subsidy work?

CRA will be setting up an online portal in the coming days which will allow you to apply for the subsidy. You will need to reapply every month. Access to the portal may require access to My Business Account, so we suggest that you--if you have not done so already--register for that service on the CRA website as soon as possible;

Payroll records have to be submitted to CRA showing what you PAID to the employee pre-crisis and what you have PAID to the employee now;

It is required that proof be issued that the wage has been PAID to the employee;

A subsidy of 75% of the wage up to a maximum of $847/week will then be paid to the employer. Direct deposits are encouraged to be set up; and

Employers must apply monthly for this subsidy.

The 75% subsidy requires the employer to fund the remaining 25%. What if the employer cannot afford to do this?

Today, Finance Minister Morneau acknowledged that they know that some businesses will struggle. Their priority is to keep individuals on the payroll to provide a sense of comfort and security for the individuals and to ensure the economy will ramp up quickly once the crisis is over. To do this quickly, companies must have their workforce in place. It is imperative that an employer proves that they are doing all that they can do to live up to the 25% responsibility. This is more important than being able to meet the 25% requirement.

How quickly will I receive my money under the payroll subsidy programs?

Under the 10% subsidy program, you will receive the funds immediately as the subsidy is received through a reduction in the payroll remittance paid. Under the 75% subsidy program, the government is hoping for a 3 – 6-week turnaround. If you have direct deposit setup you can expect to receive your funds sooner. If you do not have direct deposit setup with CRA, you can do so through My Business Account

When will the portal be available for the 75% payroll subsidy and how do I access it?

The government hopes to have the portal available within 3 weeks but acknowledges that it may take 6 weeks.

Should I utilize these subsidies or just lay off my staff?

This is a tough question. Good employees can be hard to come by and you have probably spent years training them. Ask yourself whether when this crisis is over, will your business be able to ramp up immediately. Will you have the staff to be able to run your operation immediately or will you be at risk if these employees are not available because they have gone to work elsewhere. If these are valid concerns, you will want to do all that you can to keep the employees on the payroll. Access the wage subsidy and do what you can with the government resources to get by.

If topping up the 25% wage is not achievable, Minister Morneau clarified that if businesses later demonstrate they could not, then they will not be penalized for not topping up wages. The takeaway is: the government is encouraging you to keep or rehire your employees to the best of your abilities.

What if I already laid off my staff but I want to take advantage of this subsidy?

Rehire your employees. Determine which wage subsidy you will engage and follow the noted reporting requirements.

What measures are in place to ensure that these programs are not abused?

The government is relying on trust and honesty but have strictly warned that very stiff penalties will result to anyone/business who abuses these programs. We suspect that after the crisis has passed CRA will heavily audit these claims.

Canada Emergency Business Account

Who provides this and what businesses qualify? What are the restrictions on use of these funds?

The Canada Emergency Business account is a non-interest-bearing line of credit (“LOC”) that can be accessed through your business commercial bank or lending institutions. This should be available now or will be in the very near future.

Qualifying businesses will have access to a $40,000 line of credit that has a 0% interest rate with no fees and requires no principal repayments until December 31, 2022. If repaid in full by December 31, 2022 the government will forgive the lesser of 25% of the LOC accessed or $10,000.

What are the restrictions for the use of these funds?

The LOC funds MUST be used to pay for operating costs that cannot be deferred: such as payroll, rent, utilities, insurance and property tax. Clients must sign an agreement confirming to such.

What businesses qualify?

The following criteria must be met:

The business must be an operating business in operation on March 1, 2020. Holding company’s do not qualify;

The business payroll expense in the 2019 calendar year was between $50,000 and $1 million; and

This funding cannot be sought at multiple financing institutions. Only one LOC is available to one business.

If my business accesses the LOC, can I close the account at any time without penalty?

Yes. Any balance owing can be repaid at any time. If the whole balance is repaid by December 31, 2022, there will be no interest charges or service fees.

We hope that this helps you understand the measures that the government has recently announced and has provided insight into some questions that you may have.

Please reach out to us to answer your specific questions or to help you walk through payroll subsidy calculations. (902)-742-2333 or email us.

We are all being affected by COVID-19. All of us will be called upon to do our part in helping survive this storm and be able to ramp up the economy when we come out of this. We are here to help you, your family, and your organization make it through to the other side.

We wish you the best and hope that you stay safe!

Previous updates:

Government of Canada information regarding the Temporary Wage Subsidies for Employers:

CFIB Covid-19 Small Business Help Centre information- Everything you need to know to keep your business safe.

https://www.cfib-fcei.ca/en/small-business-resources-dealing-covid-19

The Government of Canada released the following statement regarding their plan to take immediate, significant and decisive action to help Canadians facing hardship as a result of the COVID-19 outbreak.

The following is a short but worthwhile read for businesses regarding Covid-19: https://www.mystrategyup.com/2020/03/17/all-for-a-better-new-tomorrow/?fbclid=IwAR1W7SXtzEGvKXLdjXJjhgPAal3SfUi6l6__uFUZ9BvovKOIOIvYCg44nJQ